The Art of Portfolio Construction in Crypto: Insights from Matt Hougan

Title: Unraveling Crypto Investing: A Deep Dive with Matt Hougan

Is Diversification the Key to Crypto Investing?

In the whirlwind of crypto investing, it's easy to get lost in the complexity. A popular mid-wit meme recently caught my eye, highlighting the common misconception of 'the more complex, the better' when it comes to crypto investments. But surely going all-in on a memecoin is not the best approach either?

To unravel this conundrum, I turned to an expert in the field - Matthew Hougan, the Chief Investment Officer at Bitwise Asset Management. Matt joined me on the podcast, and what followed was an insightful conversation that shed light on the art of portfolio construction in the crypto world.

"Institutional investors just want broad-based exposure. And for them buying an index that guarantees that they'll participate in crypto's growth over time without having to worry about, you know, was the recent 25 minute delay in finalization of Ethereum and issue or not, right?"

Key Takeaways:

- Crypto in the Digital Age: Matt believes that cryptocurrency is the way for money to move in the digital era and is one of the most disruptive technologies of our time. He states, "That it is the way for money to move in the digital era. We're an increasingly digital age, and of course it's going to be one of the most disruptive technologies of our time."

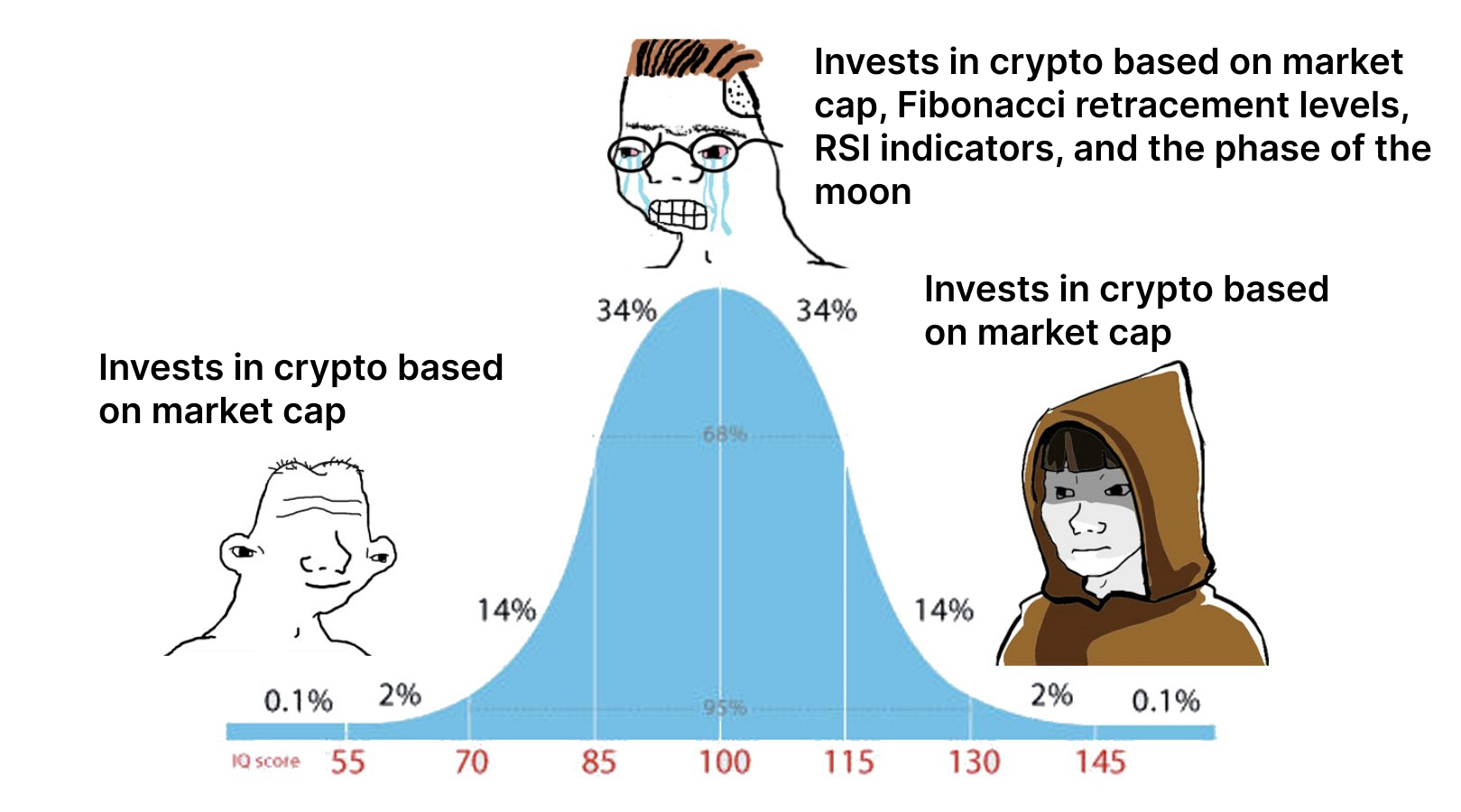

- Portfolio Construction: Matt discusses the importance of portfolio construction and the art of choosing the right coins. He explains that for institutional investors who don't have as much time to spend on this area of the market, buying an index that guarantees broad-based exposure to crypto's growth over time can be a good strategy.

- Avoiding Crypto Blowups: Matt talks about how they try to avoid investing in assets that have risks that could one day cause them to blow up. For instance, they avoided investing in Luna because they identified the flaw that would cause it to blow up.

- Choosing the Right Coins: When asked about how to pick the 10 cryptos that make it into the fund, Matt explains that the primary driver is market capitalization, which he believes is a proxy for its likelihood of success. He also mentions that they try to avoid assets that have specific regulatory risk for the domicile that they're investing in. Additionally they do research and vet each project on their technical merits. avoided investing in Luna for instance the Luna collapse.

- The Future of Crypto Investing: Matt shares his optimism about the future of crypto investing, stating that he believes we are in a new major bull market cycle. He also discusses the challenges and opportunities of introducing traditional investors to the world of crypto.

- Political Landscape and Crypto: Matt expresses his concerns about the political landscape in the US and its impact on crypto. He believes that the US is potentially squandering a leadership position in crypto to its peril.

This episode offers a deep insight into the minds of the big players in the crypto world and is packed with valuable lessons that can be applied to your crypto journey. Don't miss this chance to learn from one of the leading voices in crypto asset management.

Links:

Transcript